2025 Standard Deduction Married Joint Senior - 2025 Tax Brackets Married Jointly Single Cherye Juliann, This deduction also cannot be claimed if modified adjusted gross income exceeds the annual limits. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and. 2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, In wake of the global medical concerns arising post. Seniors over age 65 may claim an additional standard deduction.

2025 Tax Brackets Married Jointly Single Cherye Juliann, This deduction also cannot be claimed if modified adjusted gross income exceeds the annual limits. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and.

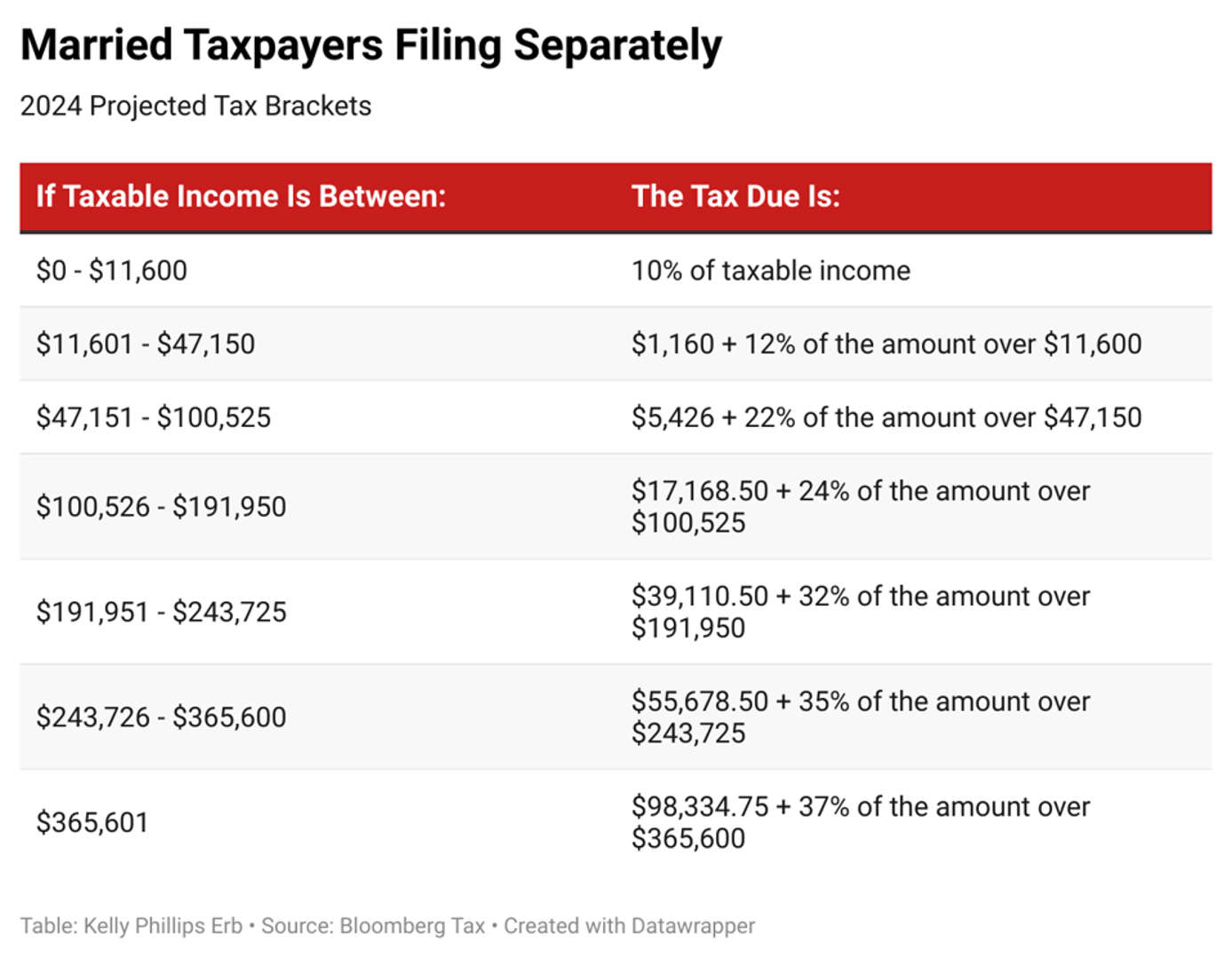

2025 Tax Brackets Married Filing Separately 2025 Hetti, The standard deduction rises to $29,200 for married couples filing a. The amount of the additional standard deduction varies depending on filing.

2025 Tax Brackets Standard Deduction Desiri Beitris, Annual inflation adjustments for ty 2023 and 2025. For 2025, that extra standard deduction is $1,950 if you are single or file as head of household.

Get updated on property taxes, income taxes, gas taxes, and more! Annual inflation adjustments for ty 2023 and 2025.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, Section 194p of the income tax act, 1961 provides. 2025 standard deduction over 65.

Irs 2025 Standard Deduction Married Ailyn Atlanta, The additional standard deduction for the aged or the blind will be $1,550. The 2025 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, That’s because the standard deduction for 2025 is $14,600 for single taxpayers, $29,200 for. There will also be changes for the standard deduction for the 2025 tax year, the agency said.

Irs provides tax inflation adjustments for tax year 2025.

A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year. Annual inflation adjustments for ty 2023 and 2025.

Tax Standard Deduction 2025 Lesya Octavia, Annual inflation adjustments for ty 2023 and 2025. In wake of the global medical concerns arising post.

2025 Standard Deduction Over 65 Married Joint Angele Madalena, Annual inflation adjustments for ty 2023 and 2025. The standard deduction rises to $29,200 for married couples filing a.